how likely will capital gains tax change in 2021

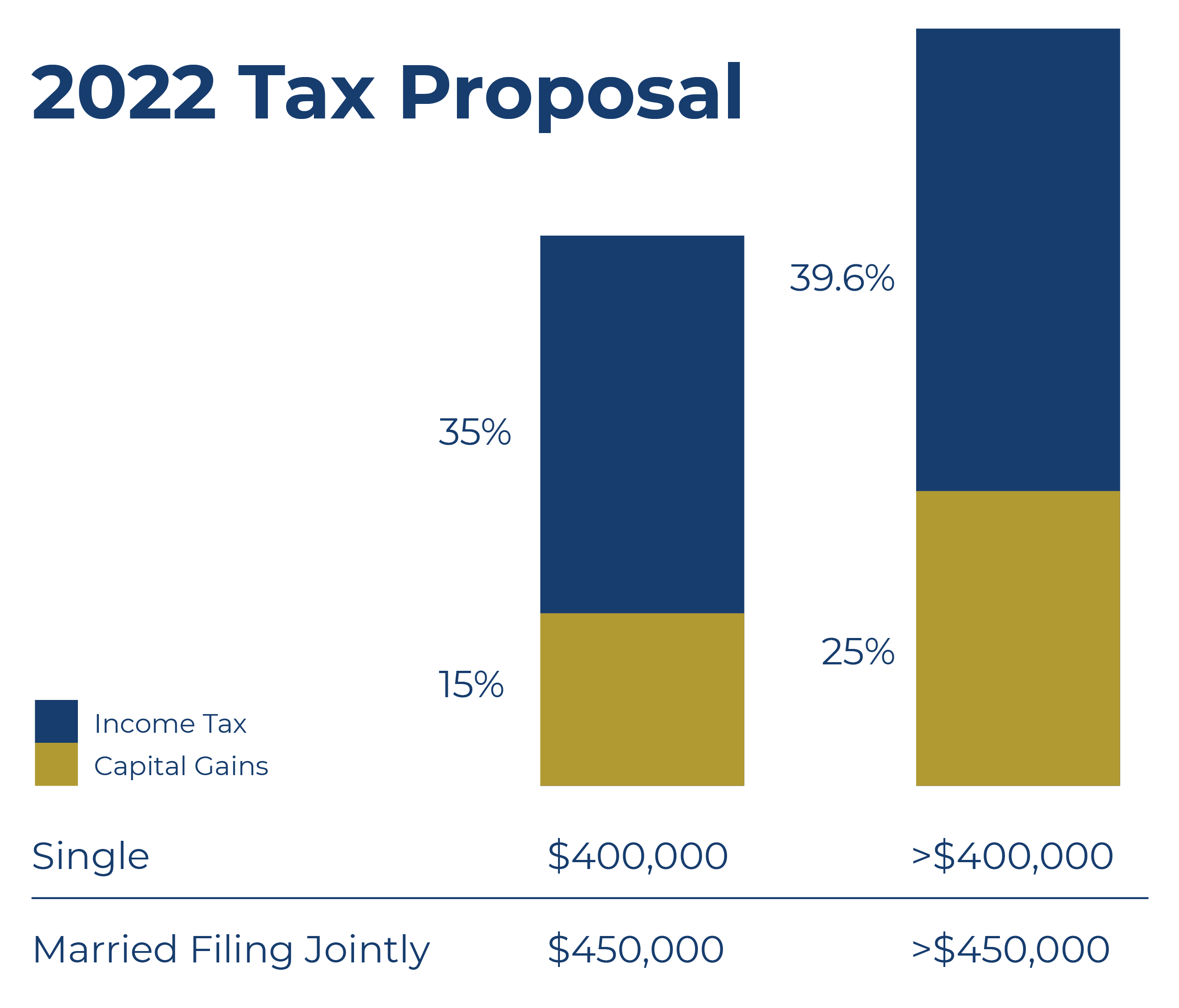

Due to potential changes in the tax. The Biden administration has put forth a widely publicized plan to increase capital gains rates from 20 to 396 for the highest wage earners which likely includes agents and.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Long-term gains still get taxed at rates of 0 15 or 20 depending.

. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. As a business seller if you are in. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Depreciation on HVAC 9800 for residential rental property. Sun Oct 24 2021.

Rather than paying taxes on a 20 gain in the price of each share of stock an heir should be able to claim a 15 loss in the real value of each share. However it was struck down in March 2022. If you must report capital gains and losses from an investment in the past year youll need to.

The bank said razor-thin majorities in the House and Senate would make a big. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

In 2021 the estate and gift tax exemption of 117 million 234 million for married couples will still allow your clients to pass on up to that amount before paying any estate tax. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some. For calendar year 2022 for all taxes except Real Estate Tax and Liquor Tax interest is charged at the rate of 5 per year 042 of the unpaid balance per month.

My understanding is that this is depreciated over 275 years. Capital Gains Tax Example. This tax change is targeted to fund a 18 trillion American Families Plan.

The Biden Administration has proposed significant changes to the income tax system. The Biggest Shake Up In Capital Gains Tax Ever. These taxpayers would have to pay a tax rate of 396 on long-term capital gains.

Democrats are so grasping. Crucially Capital Gains Tax refers to the gain you make not the amount you receive for the asset. Assets other than stocks may have different rates for capital gains taxes.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. In other words for every 100 of capital.

The current 2021 gift and estate tax exemption is 117 million for each US. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. This means youll pay 30 in Capital Gains.

Capital Gains Tax UK changes are coming. 2 days ago You may have to report compensation on line 1 of Form 1040 US. Does it qualify for SEC 179 or the.

The IRS also charges high-income individuals an additional net investment income tax NIIT at.

The Potential Impact Of The Capital Gains Tax Hike Christian Foundation Of America

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

How To Avoid Capital Gains Tax On Rental Property In 2022

Selling Your Business In 2021 How Capital Gains Tax Changes Might Affect You Calhoun Companies

Capital Gains Tax In The United States Wikipedia

Capital Gains Trade Nears Potential Deadline As Legislation Looms

American Families Plan Tax Proposal A I Financial Services

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Will Congress Reshape The Tax Landscape Bernstein

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

How To Know If You Have To Pay Capital Gains Tax Experian

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis